Oracle Cash Management Setups - System Parameters

________________________________________

Oracle Cash Management configuration:

Pre-Requisites:

Complete the below required setups to start CM setups:

- Create Cash Management

Responsibility

- Define Profile Option Values for

Cash Management responsibility

- Assign Cash Management

Responsibility to Users

- Assign Legal Entity to the Cash

Management Responsibility

Assigning the Legal Entity to Cash Management

responsibility gives the access to legal entity for cash management setups.

Note: This is very important setup and without this

setup, you cannot access the legal entity to setup CM system parameters.

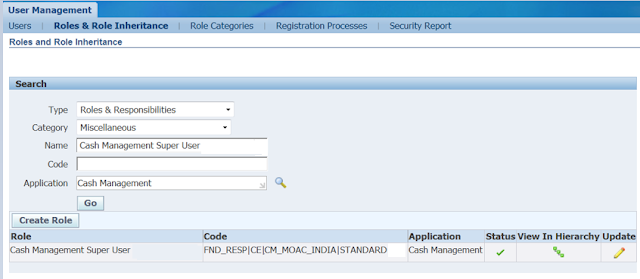

Select Type:

Roles & Responsibilities

Select Category:

Miscellaneous

Select Name: Cash

Management Super User (Responsibility Name)

Select Application:

Cash Management

Press Go

button

Then Click on Update.

Below screen will appear.

Click on Security Wizards button

Click on Run Wizard

Click on Add Legal Entities button to add legal

entity

Select Legal

Entity

Checked box Use field

Checked Box Bank

Account Grants Maintenance Field

Checked Box Bank Account Transfers

****** Pre- requisite section ended ***************************

Cash Management Setups:

Setups the CM setups to configure Cash

Management Module

Navigation: Cash Management > Setup > System > System Parameters

Navigation: Cash Management > Setup > System > System Parameters

Select Legal

Entity

Select

Ledger

Enter Begin

Date

System Controls:

Show Cleared Transactions:

If you check this check box, cleared

transactions will be available for reconciliation along with uncleared

transactions. Otherwise only unclear transactions will appear for

reconciliation.

Show Void Payments:

You need to select this option if you want to

voided payments available for reconciliations.

Add Lines to Automatic Statements:

If you check this check box, users can

add lines to existing automatically loaded bank statements.

Archive/Purge:

Use the Archive and Purge check boxes to allow

Auto-reconciliation program to automatically purge/archive the data from Bank

Statement Interface tables once the information has been successfully

transferred to the bank statement tables.

Note:

You need to run the purge/archive Bank Statement Program.

Line Per Limit:

This is the number of lines that auto reconciliation

will save at the given time.

Signatory Authorization limit:

You can select signatory approval limit manual

or workflow enabled.

Workflow enabled:

This option use the seeded business even to

change the status on the bank account signatory authority window from pending

to approved, when record is entered.

Manually Controlled:

These options allow configuring the workflow

approval process.

Cash Management Transaction:

Exchange Rate Type:

Cash Flows and Bank Account Transfer transactions use

the exchange rate specified here.

Bank Statement Cash flow Rate Date:

The cash flow program uses the date specified here to get the

exchange rate details.

Bank Transfer Rate Date:

The Bank Account Transfers use the date specified here to get

the exchange rate details.

Bank Account Transfers Authorization:

Specify whether the authorization is required to settle bank account

transfers.

No comments:

Post a Comment