Oracle ebusiness suite>Oracle

Financial> Oracle Fixed Asset (FA)

Fixed Asset Mass Addition Process:

In this article I will explain the mass assets process of Oracle Fixed Asset Module.

This process start from the payables module to Fixed Asset Module.

I assume in payables Assets Invoices are recorded and Track as Fixed Asset checked.

Oracle Payables Part:

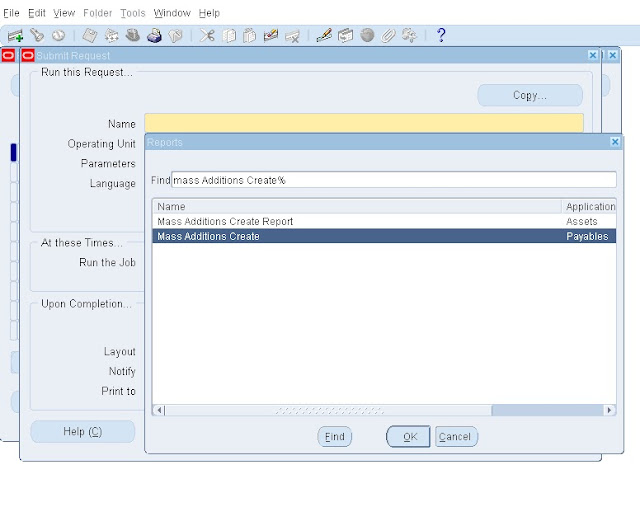

Navigation: Payables > View>Request>New Request

Select Report Mass Additions Create

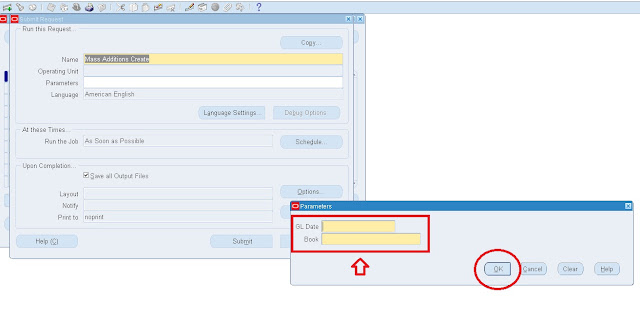

Enter the Parameter for report

Enter GL Date

Select Asset Book

Press OK

Then Press Submit to Submit the report.

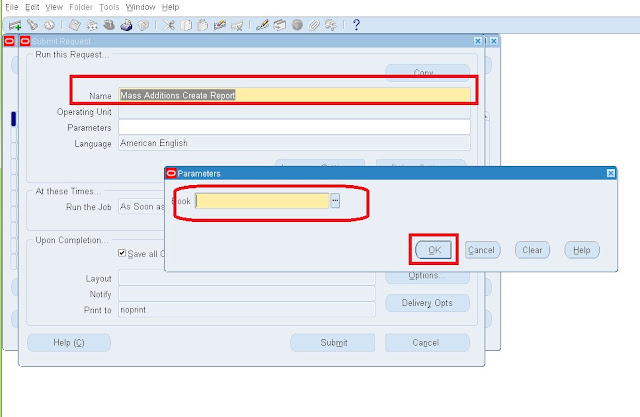

Run Mass Additions Create Report

Then Select Asset Book

And Press OK

Then Submit Report.

Oracle Fixed Assets Part:

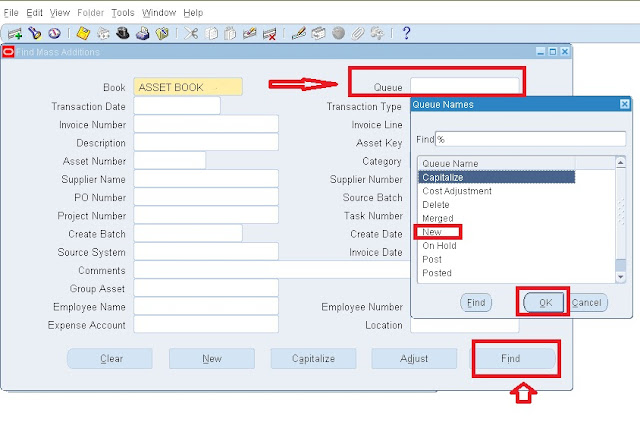

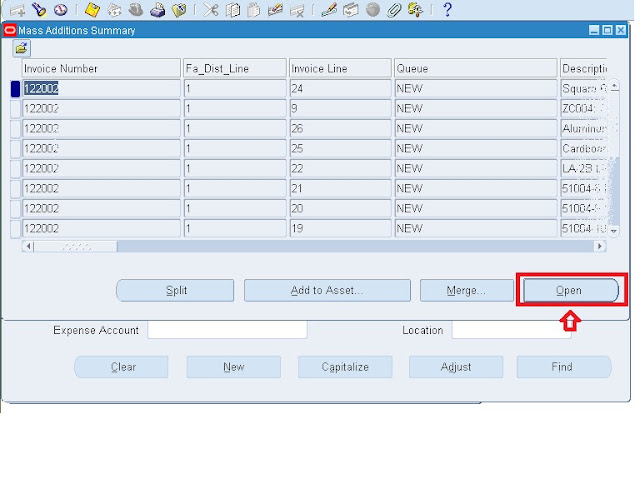

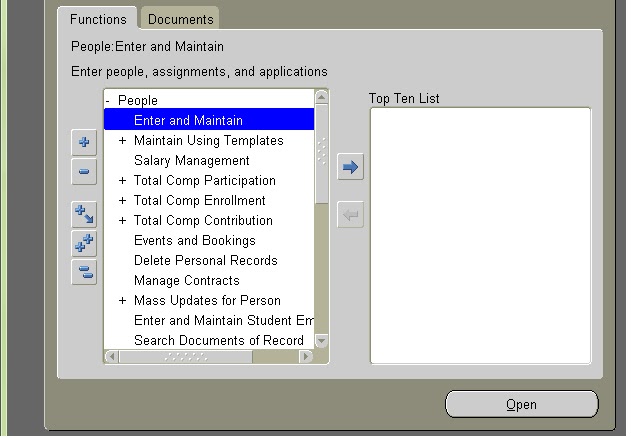

Navigation: Fixed Asset > Mass Additions> Prepare Mass Additions

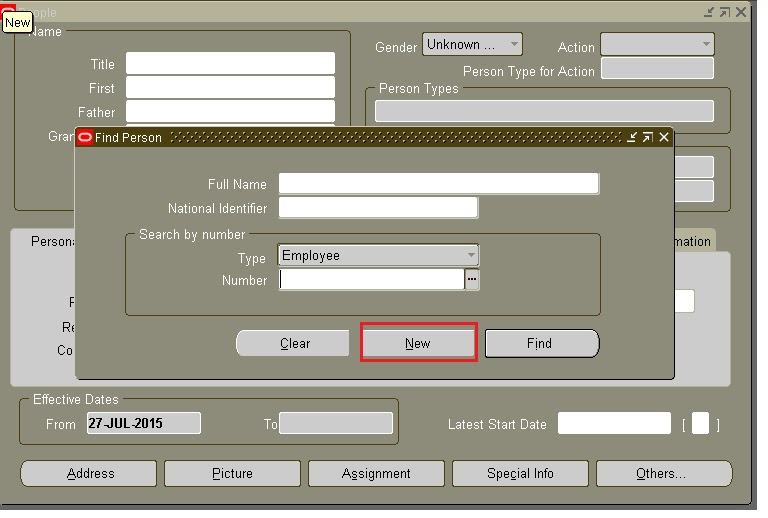

Select the Queue as New

Press OK

Then Press Find

All the invoices will come

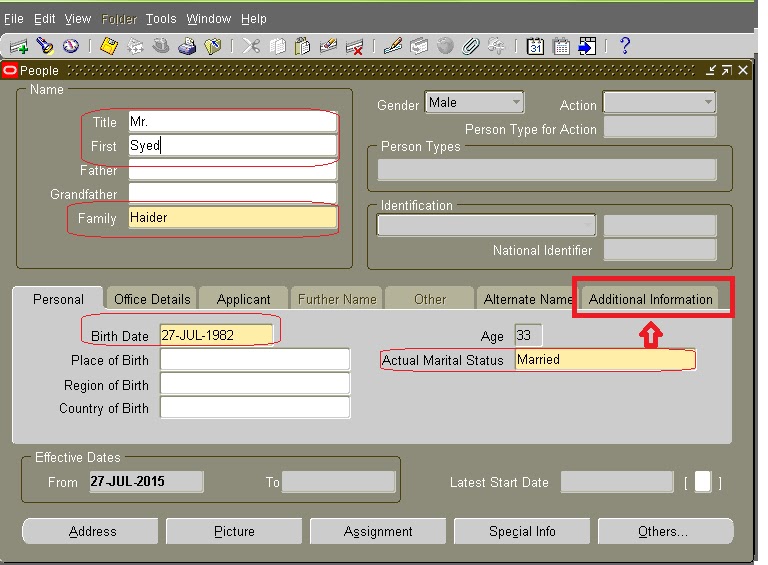

Change the Queue to POST

Select the Correct Category ( Asset Category)

Select the Expense Account

Select the Location

Optionally select the Employee Name & Number

You can change the Date in Service

Can change the Cost

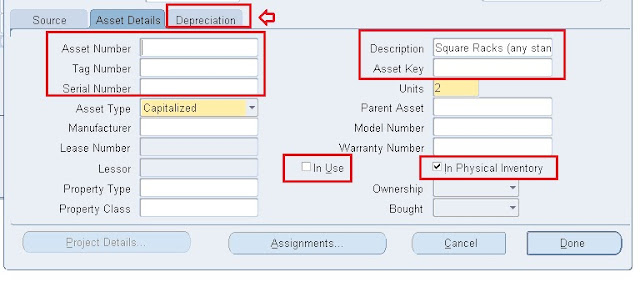

Then Press Asset Details TAB

Enter Asset Number

Enter Tag Number

Select Asset Key

Select In Use

Check In Physical Inventory

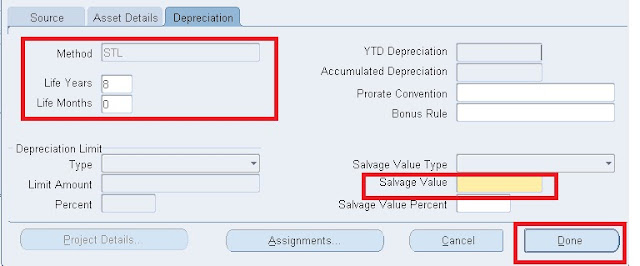

Then Press Depreciation TAB

Depreciation method will automatically selected

Enter Salvage Value

Then Press Done

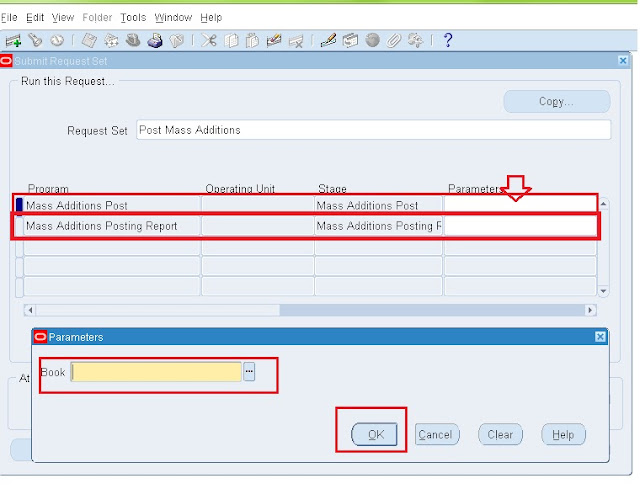

Run Post Mass addition report to post the mass addition into asset registry.

Navigation: Fixed Asset > Mass Additions> Post Mass Additions

Select the parameter for Mass Addition Post

Select the parameter for Mass Addition Posting Report

Then Press OK

Press Submit

http://docs.oracle.com/