Oracle ebusiness suite>Oracle

Financial> Oracle Receivables (AR)

How to Create Receivables Activity in Oracle Receivables - R12

Receivables Activities:

Define receivables activities to default

accounting information for certain activities, such as miscellaneous cash,

discounts, late charges, adjustments, and receipt write-off applications

Activities that you define appear as list of

values choices in various

Receivables windows. You can define as many activities as you need.

Navigate to the Receivables Activities window.

Receivables > Setup > Receipts >Receivables Activity

Enter a Name for this

activity. The activity name should not exceed 30 characters.

Enter the description of

this activity

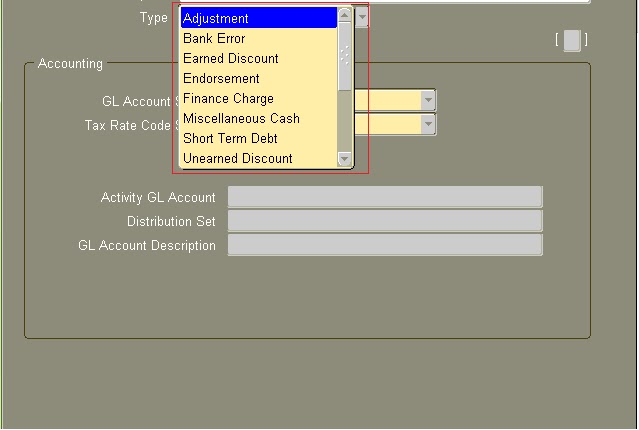

Select the Activity Type

Check on Active

Select GL Account

Source

Select Tax Recoverable

or not default is recoverable but if you select non- Recoverable you can't

change it later.

Enter the GL Account

activity

Save your work!!

Types of Receivables Activity:-

An activity's type determines whether it uses a distribution set or GL

account and in which window your activity appears in the list of values. You

can choose from the following types:

Adjustment: You use activities of this type in the

Adjustments window. You must create at least one activity of this type.

Bank

Error: You use activities of this type in the Receipts

window when entering miscellaneous receipts. You can use this type of activity

to help reconcile bank statements using Oracle Cash Management.

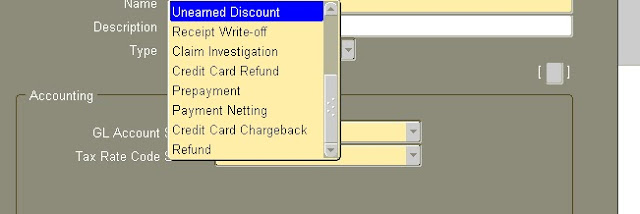

Claim

Investigation: . The receivable activity

that you use determines the accounting for these claim investigation

applications.

For

use only with Oracle Trade Management.

Credit Card Chargeback: Use activities of this

type in the Receipts Applications window when recording credit card

chargebacks.

Credit

Card Refund: You use activities of

this type in the Receipts Applications window when processing refunds to

customer credit card accounts.

Earned

Discount: You use activities of

this type in the Adjustments and the Remittance Banks windows.

Endorsements: The endorsement account is an offsetting account that records

the endorsement of a bill receivable.

Late

Charges: You use activities of

this type in the System Options window when you define a late charge policy.

You must define a late charge activity if you record late charges as

adjustments against overdue transactions. If you assess penalties in addition

to late charges, then define a separate activity for penalties.

Miscellaneous

Cash: You use activities of this type in the Receipts

window when entering miscellaneous receipts. You must create at least one

activity of this type.

Payment

Netting: You use activities of

this type in the Applications window and in the QuickCash Multiple Application

window when applying a receipt against other open receipts.

You

can define multiple receivables activities of this type, but only one Payment

Netting activity can be active at any given time.

Prepayments: Receivables uses activities of this type in the Applications

window when creating prepayment receipts.

Receipt

Write-off: You use activities of

this type in the Receipts Applications and the Create Receipt Write-off

windows. The receivable activity that you use determines which GL account is

credited when you write off an unapplied amount or an underpayment on a

receipt.

Refund: Use activities of this type in the Applications window to

process automated non-credit card refunds. This activity includes information

about the General Ledger clearing account used to clear refunds. Create at

least one activity of this type. Only one activity can be active at a time.

Short

Term Debt: You use activities of

this type in the GL Account tabbed region of the Remittance Banks window. The

short-term debt account records advances made to creditors by the bank when

bills receivable are factored with recourse. Receivables assigns short-term

debt receivables activities to bills receivable remittance receipt methods.

Unearned

Discount: You use activities of

this type in the Adjustments and the Remittance Banks windows. Use this type of

activity to adjust a transaction if payment is received after the discount

period (determined by the transaction's payment terms).

For more details please visit http://www.oracle.com/ http://docs.oracle.com/

No comments:

Post a Comment