We must define bank transaction codes in Oracle

Cash Management if we wish to use Oracle's electronic bank statements

with the Auto Reconciliation features. The codes used by our bank identify the

different types of transactions on our bank statement. We must define a bank

transaction codes for each code you expect to receive from our bank. We may

define different codes for different banks.

Cash Management defines the following possible

types:

Payment:

Payments such as

generated or recorded checks, payment batches, wire transfers, electronic funds

transfers, or payroll checks.

Receipt:

Receipts such

as received checks, remittance batches, direct debits, and bills of exchange.

Miscellaneous payment:

Payments not

associated with supplier invoices, such as petty cash transactions directly

posted to cost accounts, or bank charges.

Miscellaneous receipt:

Receipts not

associated with customer invoices, such as petty cash transactions directly

posted to revenue accounts, such as interest received.

Stopped:

Stopped payments previously entered,

generated, or cleared, such as callback of check. A stopped transaction type

matches only to Voided or Stopped payments in Payables or Oracle Payroll.

Rejected:

Receipts rejected for reasons other than

non-sufficient funds, such as an invalid bank account. A rejected transaction

type matches only to reversed receipts in Receivables.

NSF (Non-Sufficient Funds):

Receipts rejected by

the bank because the accounts on which they were drawn had non-sufficient

funds. You can reverse these receipts by creating a standard reversal. Cash

Management reopens the invoices you closed with the original receipt. When you

match bank statement lines with transactions, an NSF transaction type only

matches to reversed receipts in Receivables.

Sweep In.

Incoming funds

transfer from an internal bank account. This bank transaction type identifies

the originating bank account.

Sweep Out.

Outgoing funds

transfer from an internal bank account. This bank transaction type identifies

the receiving bank account.

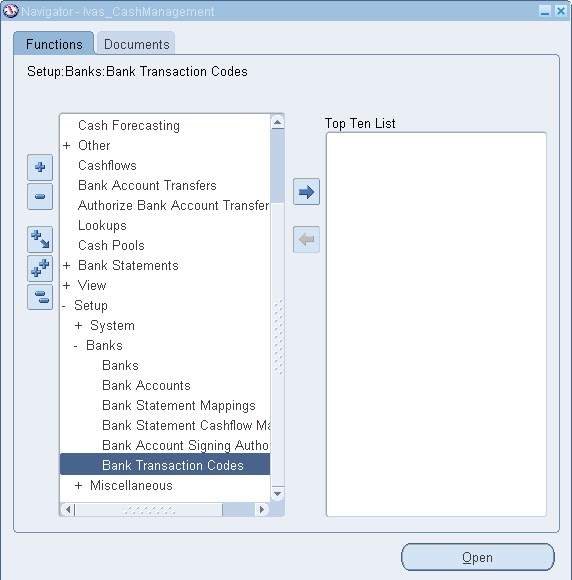

Navigation : ______________________________________

1. Navigate to the Bank Transaction Codes window.

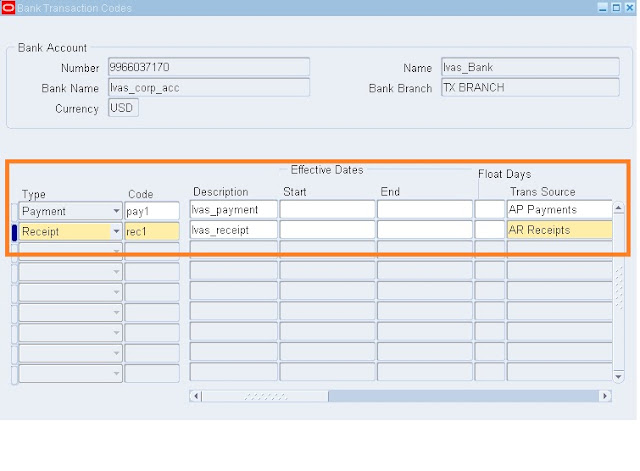

2. Select the bank, whose codes you are defining, from the Find

Bank window.

Alternatively, you can query the bank Account Number. The system

displays the Bank Transaction Codes window, which includes Bank Account and

Bank information, as well as a region for entering transaction codes.

3. For each transaction code you are defining, select a

transaction Type from the poplist. The transaction type determines how Cash

Management will match and account for transactions with that code.

4. Enter the Code used by your bank.

5. Enter an optional description of the transaction.

6. Enter Start and End Dates to determine when the bank

transaction code is considered active.

7. Enter the number of Float Days that you want Cash Management to

add to or subtract from the statement date to create an anticipated value date

for automatic lockbox receipts.

8. Enter a Transaction Source for payment and receipt

transactions. Choose Journal from the list of values to reconcile statement

lines with the assigned transaction code to General Ledger journals.

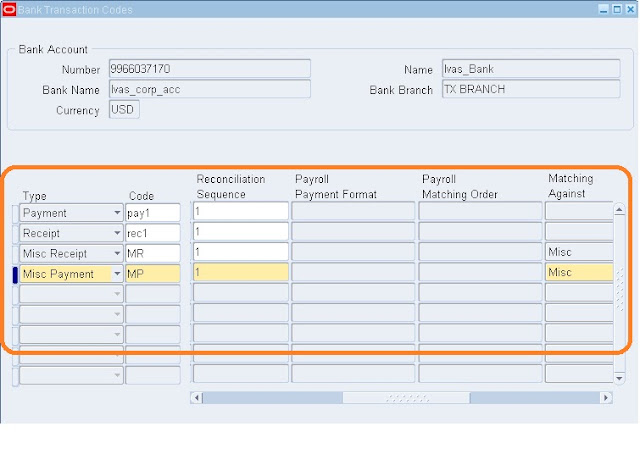

9. Optionally select a value for the Payroll Payment Format field

to reconcile statement lines with the assigned transaction code to Payroll EFT

payments. T

10. If the transaction Type is Miscellaneous Receipt or

Miscellaneous Payment, enter the Matching Against field to determine the order

of matching and the type of transactions to match.

§

Misc: Only match against miscellaneous transactions.

§

Stmt: Identify the statement line as a correcting entry. The

statement line will match against existing statement lines. The netted amount

of these lines is used to match to subledger transactions.

§

Misc, Stmt: First try to match against miscellaneous transactions, if there is

no match, then try to match against statement lines (corrections).

§

Stmt, Misc: First try to match against statement lines (corrections), if there

is no match, then try to match against miscellaneous transactions.

11. Choose the Correction Method your bank uses when correcting

bank errors: Reversal, Adjustment, or Both.

This field is only applicable for those Miscellaneous Receipt or

Miscellaneous Payment transaction codes that may be used to match to correction

statement lines.

12. Choose whether to Create transactions for any Miscellaneous

Payments and Miscellaneous Receipts reported on the bank statement when no

transaction number is provided.

13. If you chose the Create option in the previous field, specify

the Receivables Activity type and Payment Method for any miscellaneous

transactions (receipts or payments) you create from within Cash Management.

14. Define each additional bank transaction code, following the

previous steps.

15. Save your work.